2024 Kansas Child Support Guidelines Changes - Commentary by Brian Mull eFamilyTools.com

Jan 10 2024Note: This blog post was initially released January 1st, 2024 and may be continually updated throughout 2024. See the date above for last revision.

The Kansas Supreme Court has released the 2024 Kansas Child Support Guidelines! The Kansas Child Support Guidelines are updated every 4 years pursuant to Federal Law 45 C.F.R. § 302.56. Updates usually involve adopting the contracted economist's updated child support tables and making language revisions to certain sections of the guidelines. Language revisions are made due to Supreme Court decisions/opinions (case law), changes in governing Federal and State laws, and the opinions of the 13 committee members.

Judges, practicing family law attorneys, DCF, and other practitioners comprise a majority of committee members. While two members of the committee must be parents (as of 2012), their role in decisions is typically minimal. So, the guidelines are drafted by the same judges and attorneys actively enforcing them in court. This has been the practice in Kansas since 1987. Some committee members have even been retained for 38 years!

Initial Insights

Based on a 10-minute skim of the latest 2024 guidelines, it appears only two substantive updates have been made – keep reading. Firstly, the child support tables have been updated per the latest advice from the economist. This update occurs every review period and all of the work is done by the contracted economist. Second, the format of the guidelines has changed somewhat. It's unclear what the motivation and ultimate goals of the reformatting efforts were, but my initial take is the page count has been reduced from 68 pages to 63 and the level of complexity remains needlessly high. I don’t find the formatting changes invasive enough or well-coordinated. If the goal is to reformat, then may I suggest eliminating the archaic Roman numerals?

After a few reads of the guidelines, there are more changes than might meet the eye. The next sections will break down several aspects of the 2024 guidelines changes in detail.

Available Data

Typically, when updated child support guidelines become available, many documents are published on the website for public review. These are:

- Clean version child support guidelines

- Strikeout version child support guidelines

- Guidelines recommendations report to the Supreme Court

- Public survey results

- Economist report

- Updated appendices, forms, examples, etc.

- All meeting minutes/agendas

- All submissions to/from the committee (available upon request)

For 2024, the public is now provided with a single document – the clean version of the 2024 guidelines. I’m not sure how practitioners are going to be aware of all the changes to the guidelines without the strikeout version. But, as we’ll point out below, there are other hidden changes that may be difficult to realize for years – and changes that weren’t approved by the committee.

[Update Jan. 10, 2024]

Some of the above information appears to have been published at this time. The strikeout version has been published as well as some revised examples. Several items are still missing though.

Child Support Tables / Economist Review

The contracted economist is hired every review period to update the economic models and provide updated child support tables to the committee. In general, I think the economist does a pretty good job applying an economic model herself and another economist at WSU developed a couple decades ago. But, she works for the committee and she’s been happy to amend her recommendations in the past based on committee “policy” decisions - such as decreasing or increasing recommended child support table amounts. There is a very fine line between providing an independent, impartial analysis and selling data. I'm not making any assertions, but I have suggested for a long time that the committee hire an independent economist to review the validity of the economic model used in Kansas. Kansas child support amounts surpass most surrounding states of similar cost of living. See our blog article on this topic.

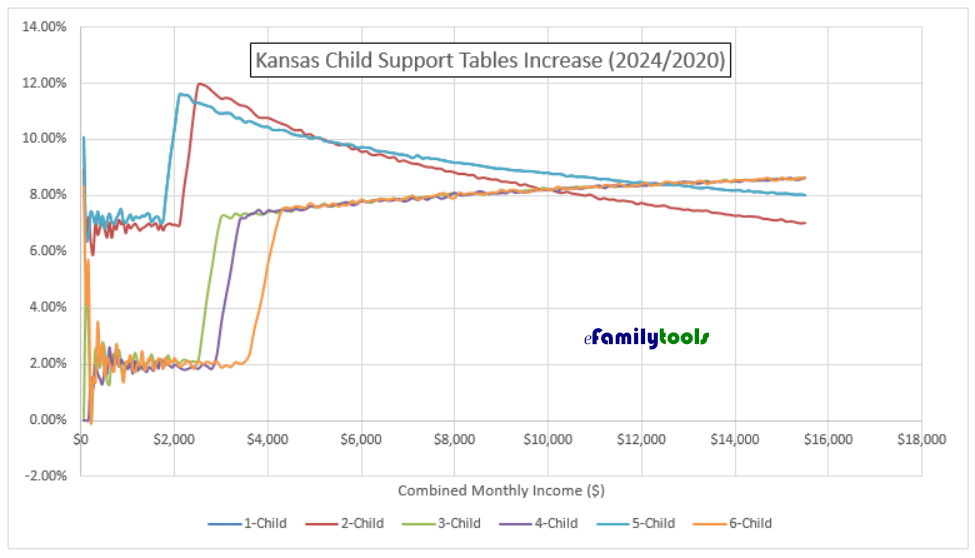

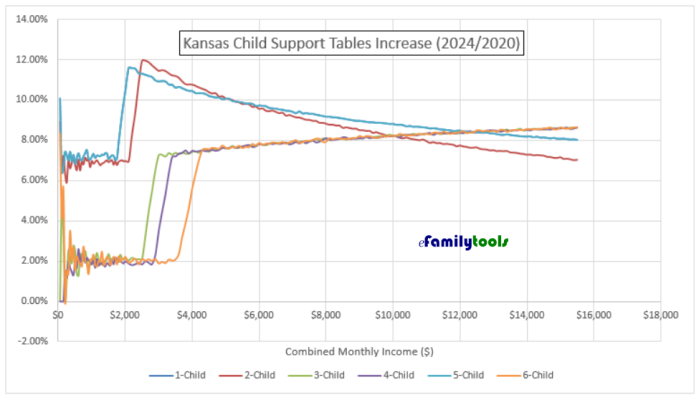

Child support tables for 2024 now extend to monthly gross incomes of $18,000. Previously, the tables terminated at $15,500 monthly gross income. As well, child support amounts have increased across the board. I analyzed the data and created the charts below for comparison. By visualizing the data, changes made to the child support tables become much more evident.

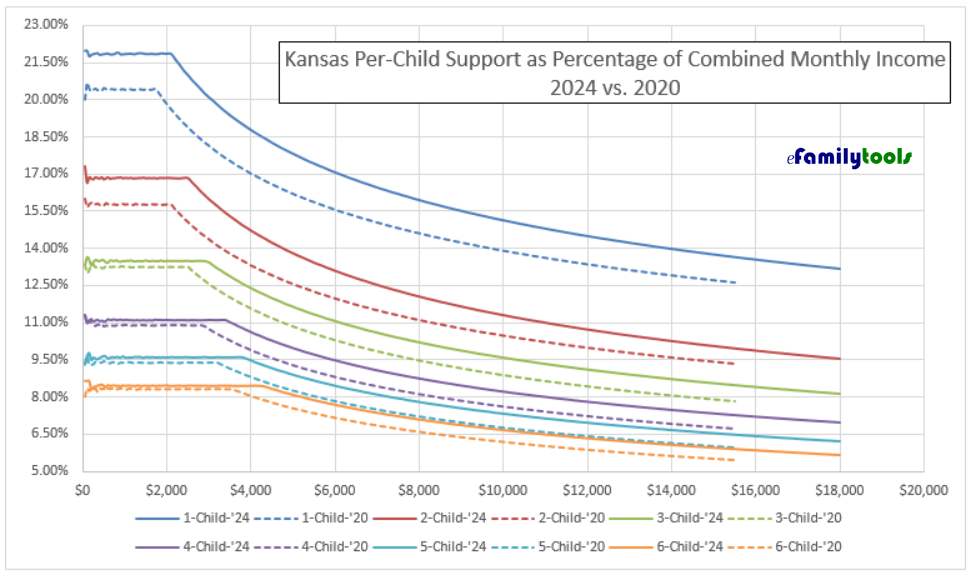

I am closely watching the percent-of-income value creep ever higher each review period. Each move higher approaches 100% - which means parents then spend 100% of their gross income on their children. We have a ways to go, but every review period it appears a higher percentage of the combined gross family income goes toward child rearing. The brake pedeal of reality has to apply at some point, right? Child rearing expenditures as a percent of gross income cannot continue increasing to 100%, can it? Of course not. But, we do see another couple percent tacked on again this review period.

Without the economists raw data, it's hard to know how the values were calculated. But, since the economist is funded by taxpayer dollars, shouldn't all the raw data be available? At least to my knowledge, that has never been the case. The state has only ever been delivered a set of static tables and limited charts. To create a better view of the actual impact of the 2024 guidelines to the previously approved 2020 guidelines, I created the chart below.

The above chart presents actual 2024 child support obligations as a percent of gross combined monthly income. In Kansas, families follow a different chart pattern depending on how many children are supported. It is clear that the 1-child and 2-child families see the largest increase in child support while other family structures are minimally impacted. Also of note, the 1-child support amount is significantly higher than the others.

Kansas performs all calculations against gross income. If you wanted to estimate child support as a percentage of net or taxable income, you could feasibly divide the percentages from the above chart by the sum of the Federal and State marginal rates.

Example:

1-Child

Gross Monthly Income = $4000

Federal Marginal Rate = 22% (single)

Kansas Marginal Rate = 5.7% (single)

Child Support % of Gross Income = 18.75% (from chart, 1-child)

Child Support % of Net Income = 18.75% / (1- (.22 + .057)) = 18.75% / .723 = 25.9%

[Error Alert!]

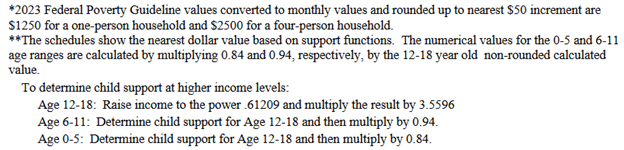

At the bottom of each child support table are the equations used to extrapolate child support obligations for monthly gross incomes beyond the $18,000 provided in the tables. Note, these equations are not used by default and are discretionary with the court. Insufficient economic data exists beyond the $18,000 monthly gross income, so the formulas are provided as a best-guess estimate. The court may elect to cap the obligation at $18,000.

The equations provided at the bottom of each table are the exact same formula, no matter how many children are involved. In all prior guidelines, these formulas were unique to each table. To illustrate how bad this problem could be, take, for example, a 1-Child family at $18,000 monthly income. The table obligation is $2147. However, if the income is $18,001, the formulas above could be applied at the court’s discretion.

(18001 ^ .61209) x 3.5596 = $1432.

So, by increasing income $1, the child support obligation drops by $715!

For a 6-child family, the table child support amount is $924 at $18,000 monthly income. At $18,001 monthly income, the child support increases dramatically to $1432, an increase of $508.

This issue is sure to cause a stir in some cases. It’s hard telling how long the error will remain in the guidelines (possibly 4 years), so we’re just making you aware of it.

Percentages / Rounding

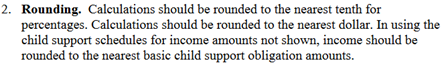

I suggested a 2024 guidelines improvement to the committee to round percentages to the nearest 0.01%. Notice how I appended a “%” unit to the end of that. The guidelines current specify to round percentages to the “nearest tenth.” Does that imply 0.10? That’s 10%!

But, I suppose if we review some example worksheets, the committee really means to say "nearest tenth of a percent". But, there is still a problem. At $18,000 income levels, 0.1% equates to $18. Yet we are directed to round dollar amounts to the nearest whole dollar? So $18 can just go missing due to lack of precision? $18 at a monthly income level of $18,000 is peanuts, but this leads hand calculated worksheets to appear in err. Why not correct the issue that was pointed out? Most of this problem is easily solved by using 0.01%. This is such a simple change.

No worries though, our software uses even greater precision to ensure hand calculated values check.

Extended Parenting Time

Section IV.H.3 of the 2024 guidelines describes the Extended Parenting Time Adjustment. This adjustment is typically used for parents who become residential parents during the summer months. While the adjustment has never accurately adjusted for summer parenting time, and has remained needlessly complex, this section of the guidelines also contains errors.

[Error Alert!]

Users are directed to apply a 50% reduction to line F.5. Line F.5 is the Ability to Pay calculation which provides low income families with a self-reserve. It appears to us, this is an obvious error. Again, we may need to wait 4 years for the committee to correct this issue. Please be advised.

Other Random Errors

It’s quite unnerving how many typos and errors are present in the latest guidelines. Some of these can drastically affect child support amounts. The below items are just additional errors you might want to be aware of until they are corrected by someone at sometime.

[Error Alert!]

- Examples referenced within the guidelines point to website links which have not been reviewed or approved by the Supreme Court. Are they merely suggestions?

- Referenced Child Support Worksheet examples haven’t been updated for 2024 and are extremely hard for users to understand without examples.

- References throughout the guidelines point to sections of the worksheet that are either incorrect or don’t exist.

- Tax examples provided refer to 2022 data. If the point of using website links is so example data can be updated easily, why is this not updated?

[Update Jan. 10, 2024]

Some of the above information appears to have been updated.